According to data provided by ITA Paris, a notable trend that has emerged in recent years is the French population’s growing preference for healthier food choices, reshaping their eating habits. Consumers in France now prioritize health, well-being, environmental considerations, and innovative products, all while valuing taste and maintaining a link with their culinary traditions.

Investment in healthy, sustainable and traceable food is mentioned as a priority in the ‘France 2030’, the recovery program for 2030, which plans to allocate, among other things, € 2 billion for better nutrition in France.

As the world gradually emerges from the pandemic, there is a renewed eagerness to engage in social activities. Despite occasional setbacks caused by the recent surge in inflation, the desire for socializing persists as a fundamental necessity, consistently prioritizing quality. According to a recent survey, when going out to clubs and restaurants, 86% of the French clearly want local food products to be offered, 79% want to be informed about the origin and quality of the food, while 77% express the need to guarantee fair remuneration to the producers of the food offered à la carte.

Such a demand for reliability, which therefore goes beyond the product quality to include other aspects of production and distribution, fits very well with consumer preferences and interest in Italian cuisine.

THE SUCCESS OF ITALIAN FOOD SPECIALITIES IN FRANCE

Italian cuisine holds a high level of appreciation among French consumers, seamlessly integrating into the local market without compromising its authentic identity. For example, pasta, tomato puree, pesto, Prosciutto di Parma, Prosciutto San Daniele, Prosecco are perfectly integrated into the eating habits of the French, just as many Italian cheeses are widely appreciated, such as Parmigiano Reggiano, mascarpone, Gorgonzola, mozzarella. In the same Italian delicatessens in France, ready-to-eat dishes of Italian cuisine recorded a sales surge of +30%.

While remaining positive, the current scenarios linked to the international economic and geopolitical crisis are to some extent orienting eating habits differently, sacrificing quantity, but without compromising the search for quality Italian products.

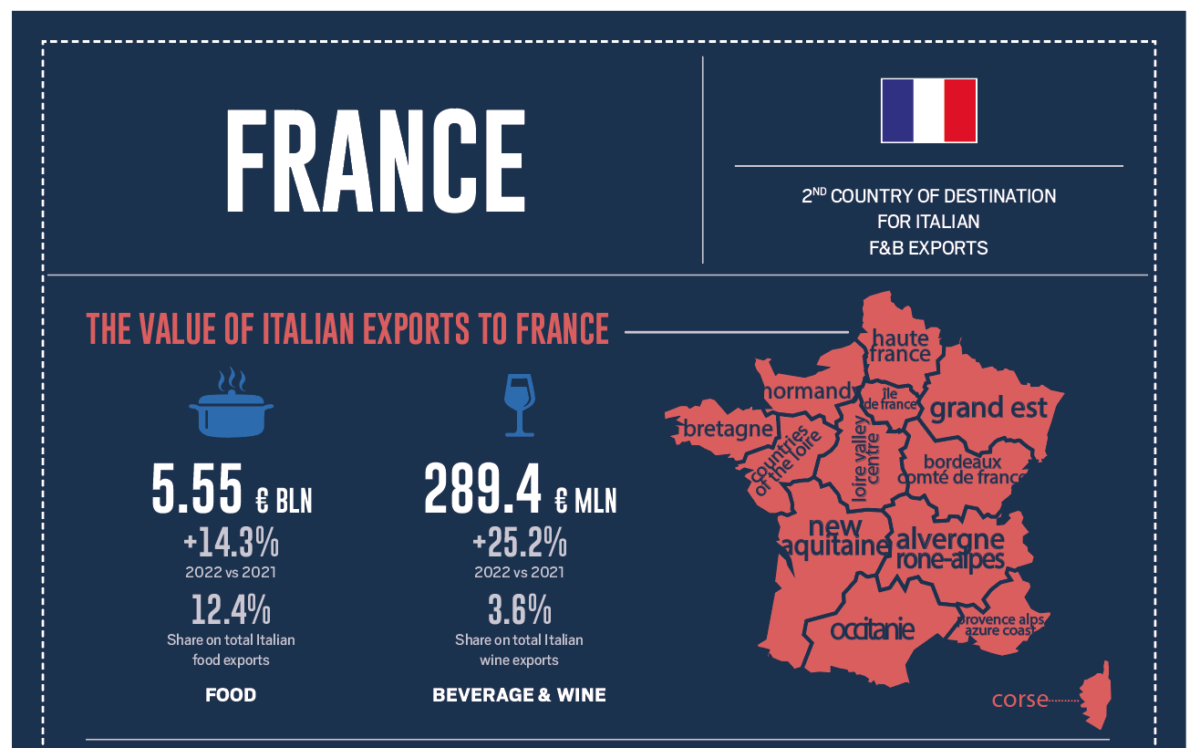

Italian exports to France confirm this trend: in 2022 exports accounted for €5.7 billion in value, an increase of 13% over the previous year and a market share of 8%, which puts Italy in 5th place among France’s suppliers in the sector.

Such figures were also unchanged in the first quarter of 2023, when exports amounted to € 1.5 billion in value, an increase of 18.15% compared to the same period of the previous year and still with a market share of 8%.

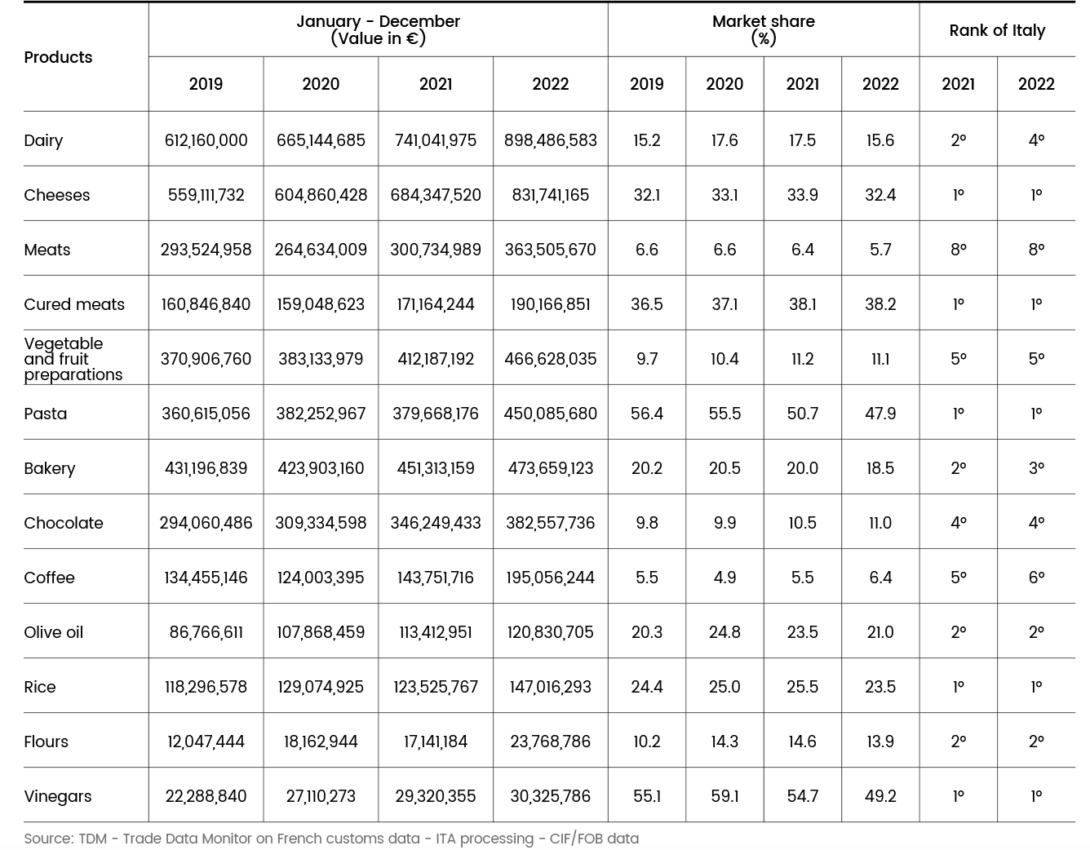

In 2022, Italy is overall the number 1 supplier in the following sectors: in cheese(+21.51%, for a market share of 32.4%), in hams and salami (+11.8%, for a marketshare of 38.19%), in pasta (+18.49%, for a market share of 47.97%), in rice(+19.01%, for a market share of 23.59%).

THE MAIN ITALIAN PRODUCTS IMPORTED INTO FRANCE AND ITALY’S POSITION AMONG THE SUPPLIER COUNTRIES