According to data provided by Nomisma, in 2022, the value of France’s imports of agri-food products grew significantly (+19.9%) compared to the previous year, rising to € 74.2 billion, a figure that represented 9.6% of the country’s total imports. In this scenario, f&b accounted for 39.9% of agri-food imports, down slightly by a few tenths of a point compared to 2021.

All food segments increased in value, but only part of the increase is due to inflation, which increased by +5.9% in 2021 and is expected to be +4.4% in 2023. Beverages also grew double-digit (+18.8%), but their share on French agribusiness is relatively low (6.4%).

Geographical proximity allows Italy to rank first as export leader in many sectors. In particular, it is France’s leading supplier of cheese and pasta. In almost all other product categories, however, it ranks in one of the top five positions.

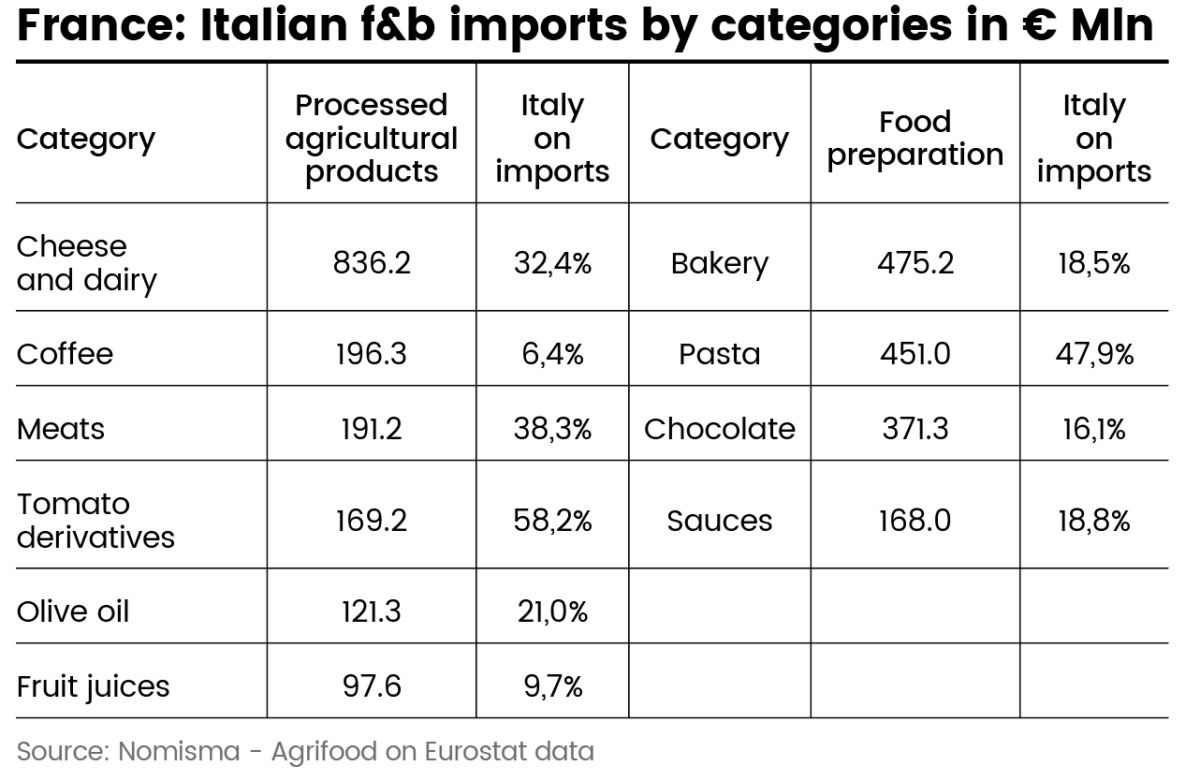

In 2022, 52.4% of the top 10 categories exported to France from Italy were processed agricultural products, led by cheese (€ 836.2 million), for a total turnover of € 1.6 billion.

Although lower in terms of number of categories, food preparations, led by bakery products (€ 475.2 million) and pasta (€ 451 million), also generated significant sales in the region of € 1.4 billion. Although squeezed between rapidly rising food prices and declining consumer purchasing power due to international turmoil in the commodities market, the Italian food supply is still at the top of French consumers’ purchasing preferences, with a movement of more than € 3 billion.

SHARP DROP IN PURCHASING POWER AMONG FRENCH CONSUMERS

Despite a stagnant economic situation (as already reported, real GDP is expected to grow by only +0.4% in 2023), the French still seem to be strongly torn between hedonism and sobriety […].

Official statistics also show the progressive decline in food expenditure, which fell from € 15.9 to 14.3 billion in the period between April 2022 and April 2023 (Source: Insee).

Due to the rising prices, at least 80% of the French changed their food shopping basket in the first months of 2023: 55% of the population gave up buying specific food products, 44% preferred to shift their purchases towards cheaper alternatives and 30% decided to reduce their spending by buying smaller quantities of the same products (Source: Elabe).

The product categories being most affected by this choice were mainly processed meat (43%) and fish (34%). Some types of bakery (cakes, biscuits, 27%), organic food (without special specifications, 26%) and ready meals (frozen, canned, 25%) were also mentioned. Only 16% of the French stated that they had not significantly changed their food spending habits during the period covered by the analysis.

Read the complete article in our newsstand: Regions – France

ITALIAN FOOD: GAINING GROUND AND NAVIGATING MARKET DYNAMICS IN FRANCE

Amidst this landscape, Italian food is gaining a strong foothold. The top three food categories for Italy – cheese and dairy products, bakery items, and pasta – have shown robust and consistent growth in the first two months of 2023, with impressive double-digit sales across the board.

CHEESE

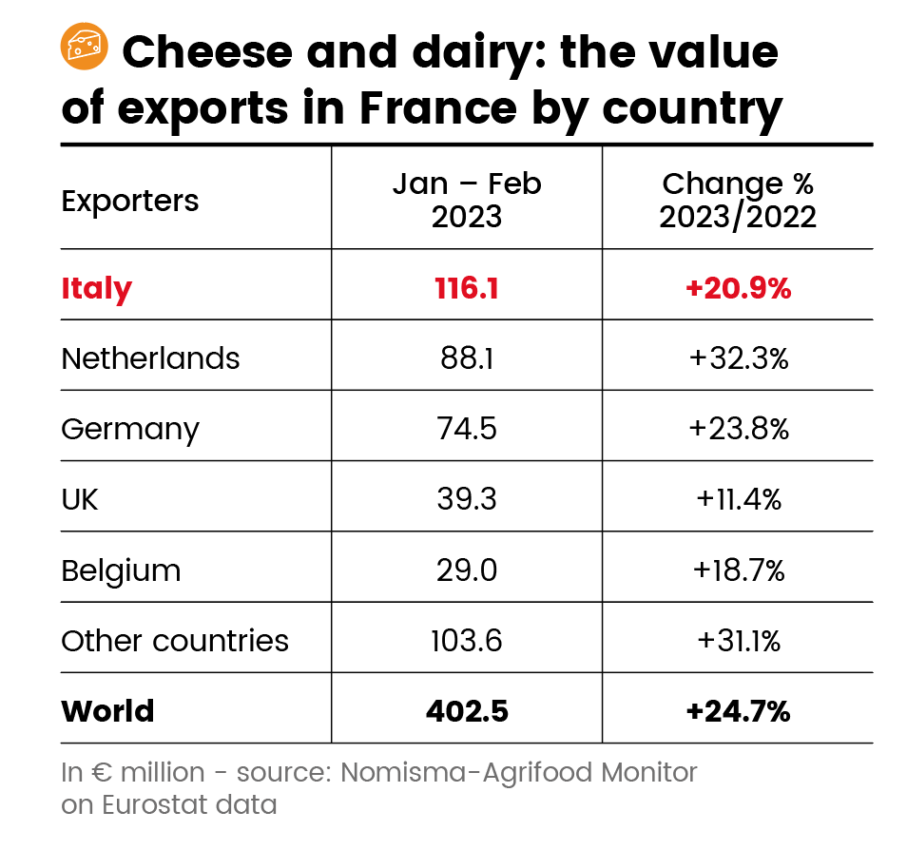

Among these, cheese and dairy products have been particularly noteworthy, recording exports of over €116 million in the same period. In this context, Italy has successfully maintained its dominant position as France’s primary cheese supplier, with an export share of 28.8%, surpassing both the Netherlands (21.9%) and Germany (18.5%).

Although the value of cheese imports from Italy grew by 20.9% in the first two months of the year, the growth rate was slightly lower than the world average (+24.7%).

Nevertheless, other key competitors, such as the Netherlands (+32.3%) and Germany (+23.8%), also displayed positive dynamics during this time. The analysis reveals a widespread growth pattern in all segments of the Italian cheese supply, with notable peaks in fresh cheese (including mozzarella with +32.2%), grated cheese (+13.7%), and hard and semi-hard cheese (+5.3%).

However, it’s important to emphasize that the increase in value for hard and semi-hard cheese imports is primarily due to a rise in the average price level, while for other cheese categories it reflects actual growth in volumes.

BAKERY

Amid the evolving food market, inflation continues to influence French consumer behavior, with a delicate balance between seeking convenience (private label, discount) and exploring alternative choices (conventional, organic, free from, rich in, etc.).

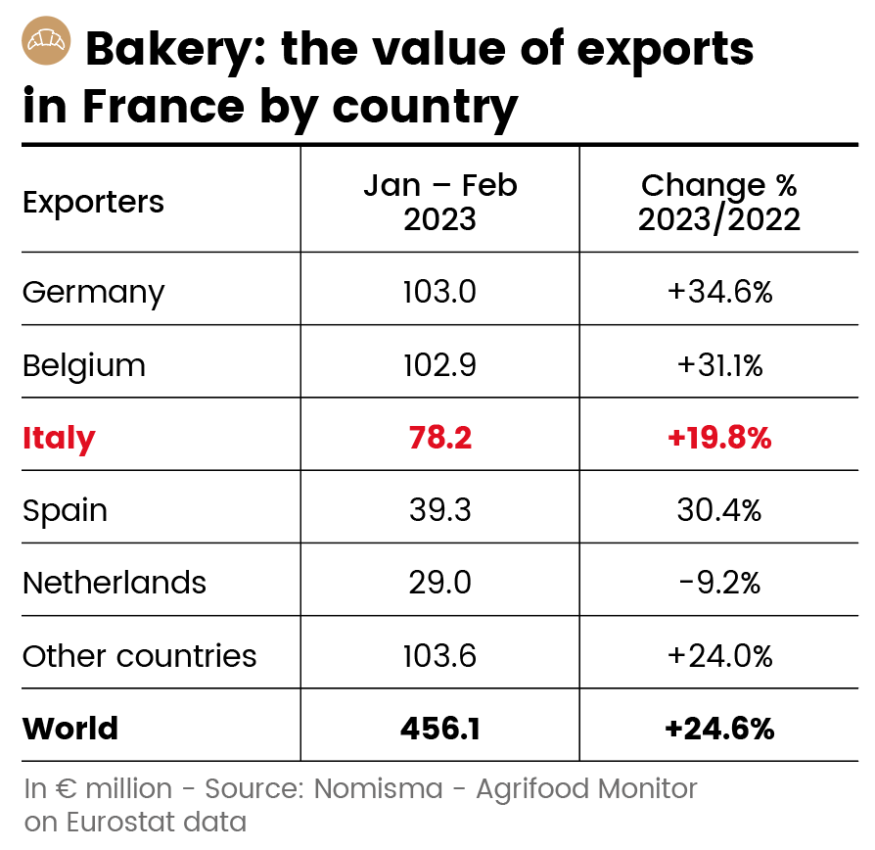

Bakery products, both sweet and savory, also pique interest for imports from France, where Italy ranks third behind Germany and Belgium.

PASTA

Furthermore, pasta remains a staple dish in France, mirroring its popularity in Italy.

Surveys indicate that 70% of French adults consume pasta at least once a week, with 36% doing so even more frequently, especially among the younger generation (Millennials, aged 18-34), where the habit rises to 49%.

Notably, spaghetti is the preferred pasta type for 23% of the French population, demonstrating their strong affinity for this classic dish.

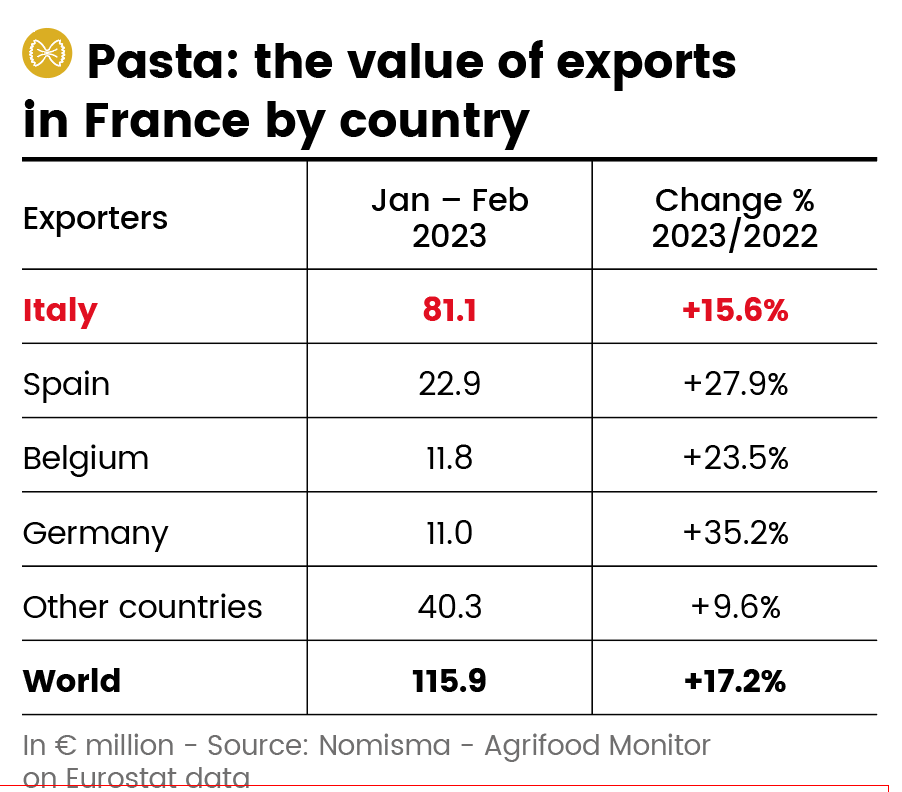

The overall consumption of pasta has been steadily in-creasing in volume and value over recent years, and 2023 saw a rise in the value of pasta imports from Italy.

While Italy’s growth rate in pasta exports (+15.6%) was slightly lower than that of other main competitors like Spain (+27.9%), Belgium (+23.5%), and Germany (+35.2%), it’s important to consider that these countries started from much lower volumes.

Despite being less dynamic in comparison, Italy remains the primary pasta supplier to France, accounting for 48.5% of the market share.

The French market shares significant similarities with the Italian market in terms of pasta usage and consumption.

Looking ahead, France aims to reinforce and reinvigorate its national durum wheat sector, where both areas and production have declined by half in the past decade. With a focus on fresh semolina pasta, the goal is to make durum wheat a profitable crop for producers, artisans, and the French industry.

To capture this customer base, the industry is introducing new products, such as pasta filled with various AOC cheeses like Comté and Bleu d’Auvergne, available in various formats and portions, including convenient snacks. This approach aims to resonate with consumers and solidify the position of Italian food products in the French market.