Many confirmations, and some surprises, emerge from the new edition of the Observatory on Italian and international food retail groups produced by Mediobanca‘s research area. The survey analyzes the economic and financial data of 116 Italian chains and 30 major international groups in the period between 2016 and 2020.

Large-scale retail stores are losing ground on the market, both in Italy and abroad. Hypermarkets are losing share, going from a 32.6% share of the market in 2007 to 26.5% in 2021. The discount network is chasing them, so much so that it has more than doubled in the same period: from 9.5% in 2007 to 24.6% expected in 2022.

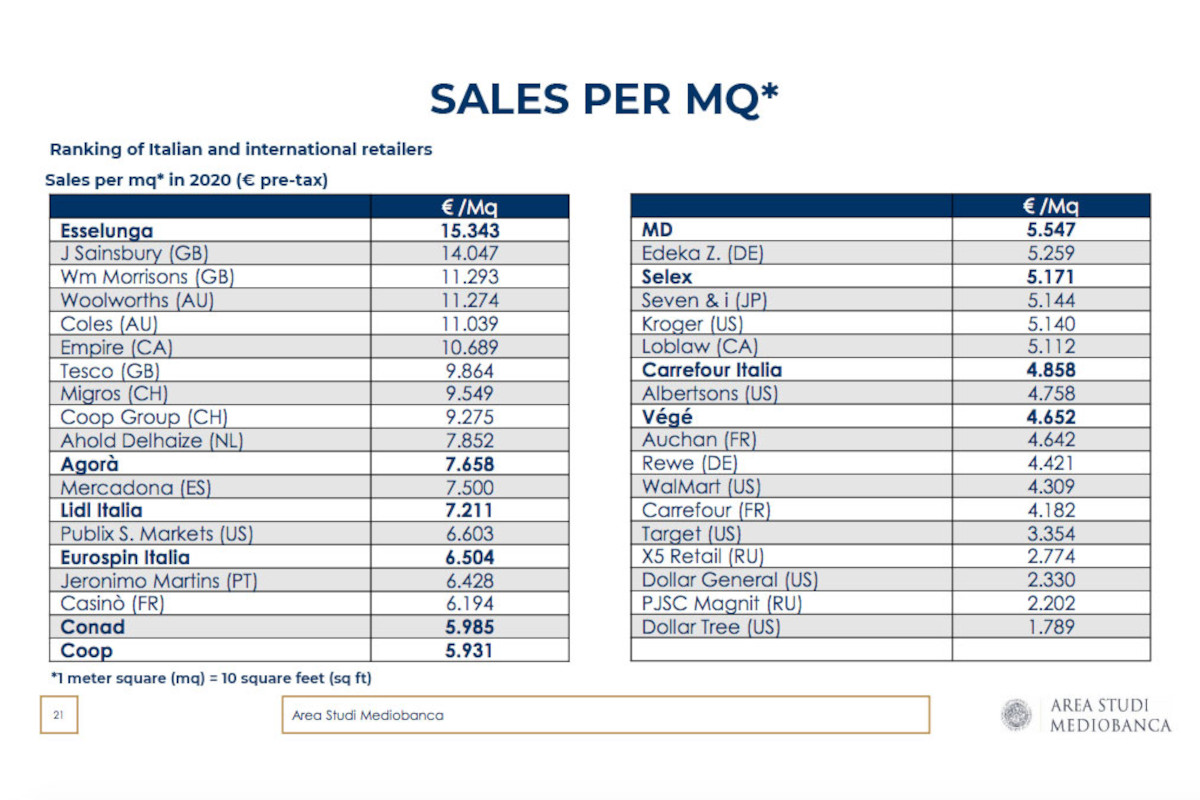

In this context, Italy’s supermarket chain Esselunga has carved out an international record: it is first in the world in terms of sales per square meter, given that with 15,300 euros it precedes the British J Sainsbury and Wm Morrison.

Discover the authentic Italian F&B products on the Italianfood.net platform

DISCOUNT STORES GAIN GROUND

The crisis of hypermarkets, which began a few years ago, continues. On the other hand, the expansion of discount stores continues, which, in terms of sales per square meter, trail the supermarkets (6,070 euros per square meter compared to 6,240 euros, data for 2020). The latter remains the real dominator of the market, with a 43.1% share. In 2021, preliminary data from the large international chains indicate sales up by +3.6%, with positive effects on industrial margins (a growth of +13.1%) and on the net result, up +16.3%.

THE PRIMACY OF CONAD IN ITALY

In Italy, market concentration is stable. The market share of the top five groups is 57.6%. In 2021, Conad held the largest market share (15%), followed by Selex (14.5%), and Coop (12.3%). 2020 proved to be an exceptional year, as sales by Italian retail groups surged +5.7 percent compared to 2019. Record sales were led by discounter MD, the champion of sales growth between 2016 and 2020 with a +10.7% average annual increase. MD was closely followed by discounter Eurospin (+7.8%), Agora (+7.6%), and Conad which grew +6.5%.

On the profit front, the record goes to the Esselunga chain with over 1.2 billion euros in sales in the period under consideration, followed by Eurospin (just over 1.1 billion), VèGè, Selex, and Conad. On the other hand, Carrefour lost 604 million euros, and Coop lost 460 million. Coop Alleanza 3.0, however, confirms itself as the largest Italian cooperative with sales of over 4 billion euros in 2020.

THE GREAT INTERNATIONAL RETAILERS

In 2020, the largest international groups achieved a turnover ranging between WalMart’s over 450 billion euros and the Russian chain PJSC Magnit’s 17 billion. About 17% of total turnover was achieved abroad. Foreign brands are ahead of Italian ones in terms of gender equality and sustainability. In the first case, the proportion of women in managerial roles abroad is close to 40%, while in Italy it stands at 17%. Italian brands also lag behind in terms of differentiated waste collection, at 67.7% compared to the 72% achieved abroad.