A recent survey by Nomisma for Afidop (the Association of Italian PDO and PGI Cheeses) investigated the consumption habits of cheeses in Europe, particularly in Great Britain, Germany, France, Spain, and Switzerland. Prospects for Italian cheeses are encouraging in view of the expected post-Covid consumption recovery, especially in the high-spending consumers segment.

Click here to discover the authentic Italian dairy products on Italianfood.net platform

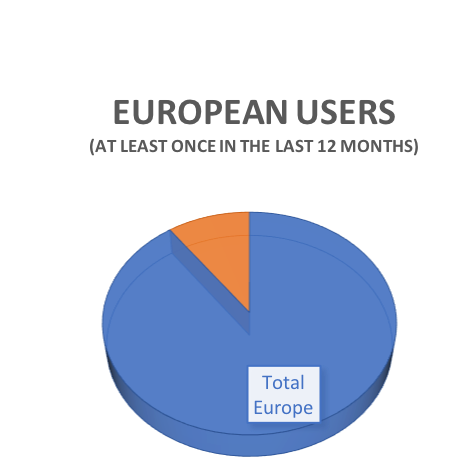

According to the research, more than 9 out of 10 European consumers (in the 5 markets analyzed) have consumed cheese in the last 12 months. The most consumed cheeses in Europe are, according to the perception of the consumers interviewed, hard cheeses (preferred above all by Swiss, French and Spanish consumers). They are followed by fresh cheeses (consumed above all in Switzerland and Germany) and semi-hard cheeses (above all in Germany – Edamer and Gouda – and Spain) and, finally, soft cheeses such as Brie and Camembert (marking outstanding performances in France).

ALL THE GOOD OF MADE IN ITALY CHEESES

According to European consumers, Italy and France rank first among the countries producing the highest quality cheeses, followed by Holland. Italian cheeses are the most consumed (with the exception of Germany and Spain, which prefer the French ones). Seven out of 10 Europeans have bought an Italian cheese at least once in the last year (with a peak of 78% in France and 74% in Spain).

The profile of the typical European consumers of Italian cheeses is very clear. They have a stable working position (among self-employed/self-employed professionals and entrepreneurs, the quota of Italian cheese consumers is 81%, among employees 75% – compared to 65% of unemployed), they are also well-off (among those with medium-high incomes, the quota of consumers grows to 78% – compared to 68% of those with medium-low incomes) and have some kind of connection with Italy (among those who have been to Italy or have family members of Italian origin, the quota of Italian cheese buyers is higher than average). Those who consume Italian cheeses also tend to be more ‘expert’ consumers, more attentive to health and quality so much so that, in families with young children, the share of users reaches 79% (10 points higher than the rate of families without young children).

Among those who predominantly choose cheeses of foreign origin, the rate of Italian cheese stands at 84%. But even among consumers who are more attentive to quality, the proportion of Made in Italy cheeses’ buyers is higher: 78% among those who choose PDO-PGI cheeses and 79% among those who buy organic cheeses. PDO, PGI, Organic and Sustainable are the key words of consumers who are most likely to put Italian cheeses in their shopping carts.

But what are the distinctive attributes of Italian cheeses? First of all, in each market a higher price is recognized compared to local products, however, this is due to a perceived superiority in terms of quality and organoleptic features.

WHAT TO EXPECT AFTER COVID

According to Denis Pantini, head of agribusiness unit at Nomisma,

“the pandemic has significantly affected the exports of Italian cheeses. However, the research highlights their still unexpressed potential on the main European markets.”

Domenico Raimondo, president of Afidop, says: “We must intensify our dialogue with the final consumer, focusing on the quality and safety of Italian cheeses, as well as on their sustainability, the added value of PDOs and their link with the production territories.”