In the last 12 years, the race of Italian food & beverage on foreign markets has never stopped. According to Federalimentare‘s survey on Istat data from 2007 to 2019 exports have almost doubled.

In the first ten months of 2020, the scenario worsens due to the impact of the pandemic: the trend of exports stands at a weak +0.1%, while still maintaining a clear advantage over the -12% of total exports.

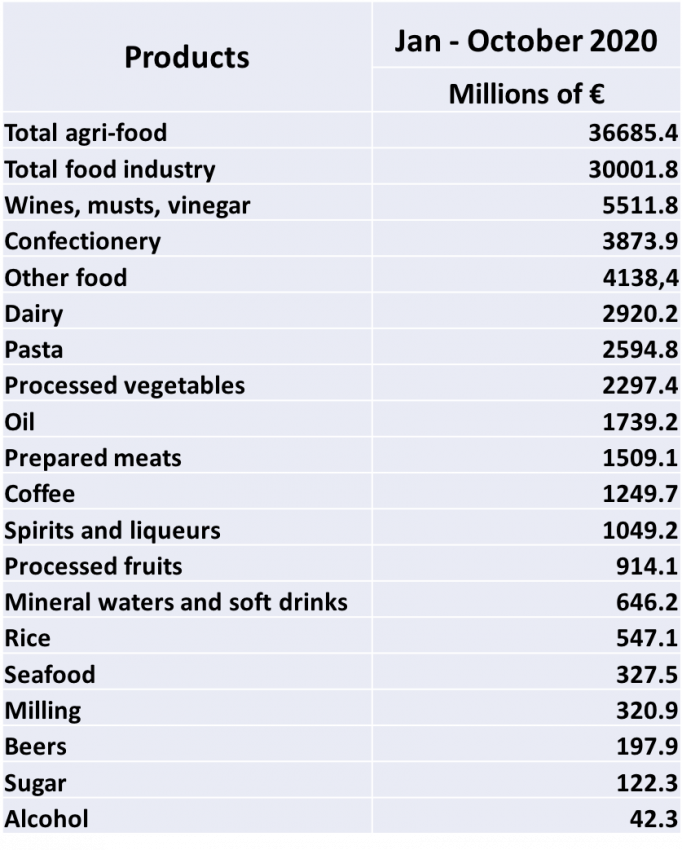

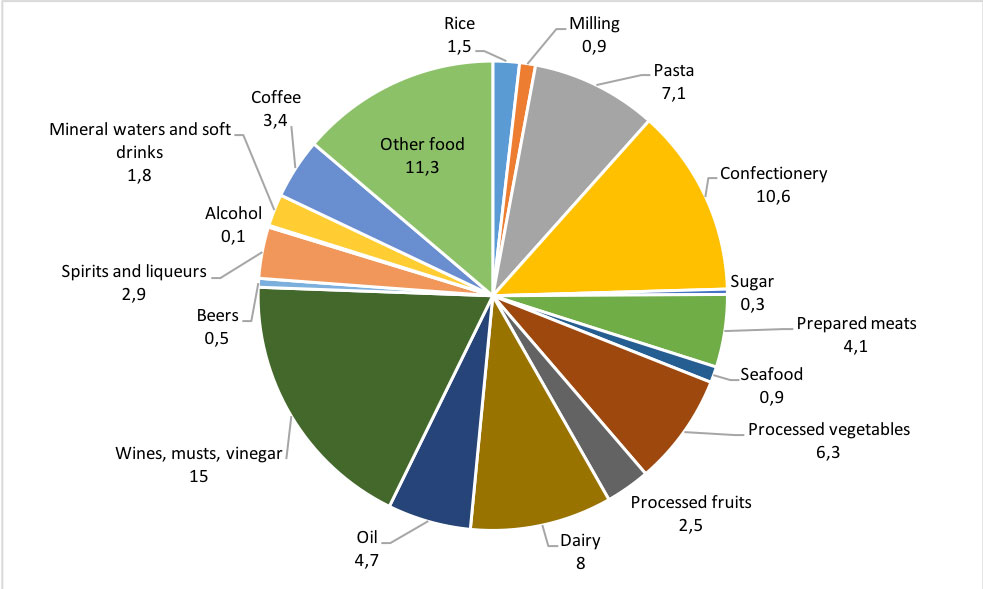

THE BEST PERFORMING CATEGORIES

The greatest progress was made by spirits and liqueurs (+88.6%) and dairy products (+38.4%). Milling (+29.9%), confectionery (+29.2%) and coffee (+23.3%) followed.

But there is one significant fact. In spite of competitors, Italian agri-food exports in the period showed a growth in average unit value of about 11 percentage points. This means that foreign consumers have recognized the quality of our food products and have accepted expansive price dynamics to buy them. It is not by chance that the PDO economy has received a great boost, thanks to the large certified productions.

THE CENTRAL ROLE OF PDO CERTIFIED PRODUCTS

The Italian PDO sector has achieved important results. The weight of the 2019 turnover of this production reached 16.9 billion. It represented in 2019 8.4% of the total agri-food turnover of the country, amounting to 202 billion (145 billion of food industry + 57 billion of primary).

On the export front, the sector reached a 2019 value of 9.5 billion euros. It covered a share equal to 21.9% of the entire Italian agri-food exports (43.4 billion). The comparison between the share covered by exports (21.9%) and the share covered by turnover (8.4%) certifies more than any comment the great exporting vocation of this production area and the growing predilection for its offers by international markets.

The greatest contribution to exports is provided by the wine sector, with a value of 5.7 billion, followed by PDO and PGI agri-food products, which amount to 3.8 billion.

OCTOBER, THE MOST DIFFICULT MONTH

Finally, a reference to the most recent economic situation. The month of October recorded an unexpected double-digit drop in agro-food exports (-13.2%), suddenly flattening the trend over ten months. What triggered the sudden loss of speed in exports in the sector was, above all, the Eu market. And yet, during the course of the year, this market was remarkably solid, still registering a 2.7% increase over the nine-month period, better than the 2.1% increase worldwide.

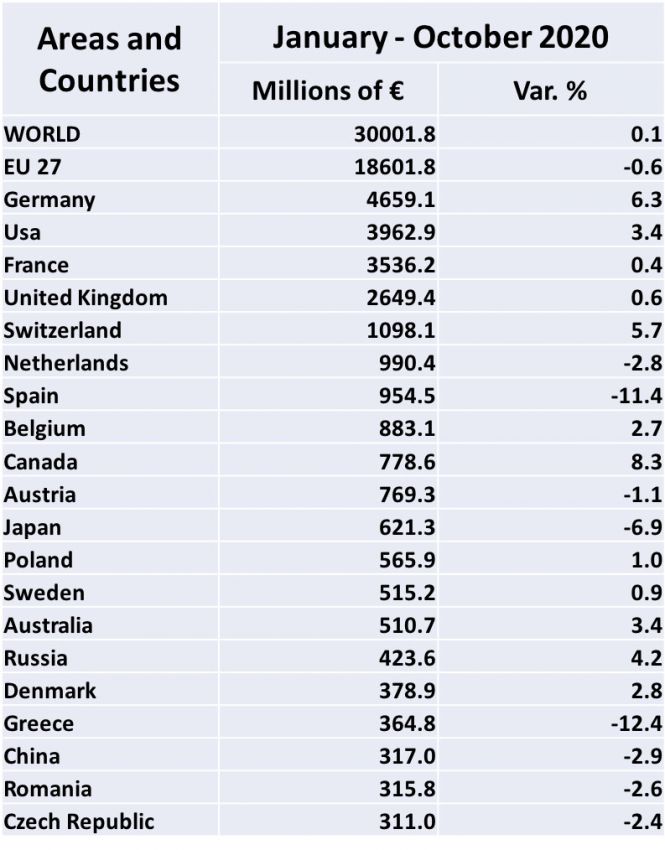

MAIN OUTLET COUNTRIES

In particular, while Germany held somewhat steady, with a rise of 6.3% over the 10 months after a rise of 7.1% over the 9 months, France slipped in parallel from +3.8% to +0.4%, the UK from +3.4% to +0.6%, and Spain from -5.3% to -11.4%. In actual fact, almost all EU markets, including major markets such as the Netherlands, Belgium and Poland, registered marked losses in speed. The lone exception was the most important European market outside the EU, Switzerland, the fifth largest outlet for our food and beverages for many years, which actually strengthened its trend slightly, rising 5.7% over the 10 months, after 5.3% in the nine months.