Deloitte presented the 22nd edition of the Global Powers of Retailing study, which analyses the results of the annual year to 30 June 2018 made public by the world’s largest retailers. According to the Global Powers of Retailing 2019 report, the world’s 250 largest retailers generated $4530 billion in revenue over fiscal year 2017 (July 2017-June 2018), up 5.7% over the previous year. “In the near future, it is likely that the economy will slow down, also due to factors such as inflation in the main markets and adjustments to the monetary and fiscal policies of governments,” explains Claudio Bertone, Equity Partner Deloitte and Head of the Retail sector. “For retailers, this will result in a slowdown in spending and higher prices for consumer goods: but also in much more difficulties in managing global supply chains”.

THE TOP 10

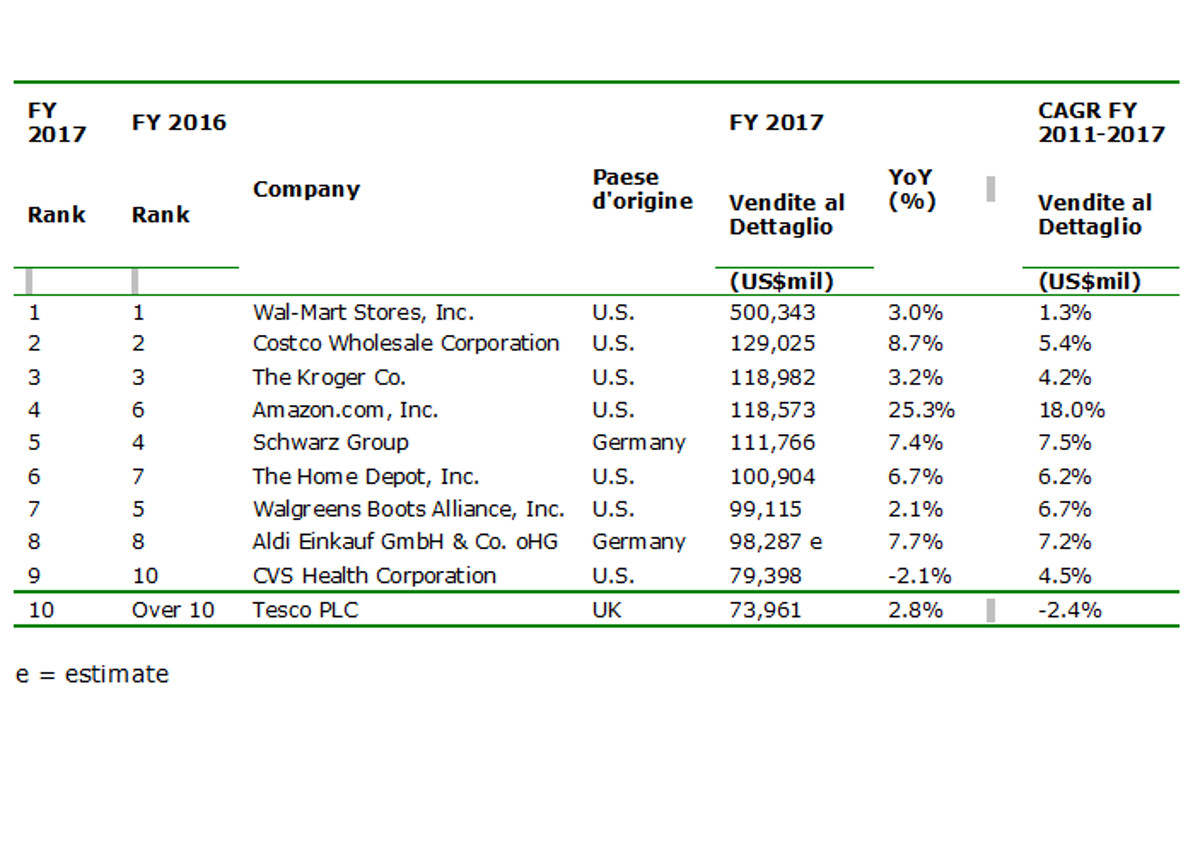

The top ten retailers in the world contribute for 31.6% of the total turnover generated by the 250 largest retailers in the world. WalMart, Costco and Kroger confirm their position on the Top 10 podium. The most significant movement is that of Amazon, which gains two positions compared to FY 2016 driven by a steady double-digit growth (25.3%), even more significant if compared to the growth recorded on average by the Top 10 (+6.1% YoY). The Top 10 companies are still growing at a higher rate than the rest of the ranking (6.1% compared to 5.7% overall, respectively), although in terms of margins there is a slight contraction compared to the previous year and a below-the-average performance of the Top 250.

EUROPE LEADING THE TOP 250 RANKING

Most of companies in the Top 250 ranking come from Europe. Their number has risen from 82 to 87 and three of them are also in the Top 10 (Schwarz, Aldi Einkauf, and Tesco PLC). Two-thirds of the retailer’s turnover in Europe comes from Germany, the UK and France. Germany is home to the largest companies, which with an average size of 24.7 billion dollars exceed the average of 18.1 billion dollars of the Top 250 companies. France, on the other hand, stands out for its internationalisation with companies operating on average in 29.2 countries. “In order to increase its market share in a very competitive and internationalised retail sector, strategic supply chain management becomes essential. A strong help certainly comes from new technologies that we call ‘disruptive’, such as Analytics, IoT and Robotics” – notes Bertone.

THE RETAILING MARKET IN ITALY

“Italian retailers also performed well overall in the year ended June 30, 2018,” Claudio Bertone explains. “All four Italian players in the Top 250 recorded an advance in the ranking: Coop confirmed its position as the top Italian giant, ranking 71st, followed by Conad and Esselunga, which ranked 73rd (+5 positions compared to FY 2016) and 121st (+10 positions compared to FY 2016) respectively. Eurospin closed the year with an advance of 19 positions, coming in 168th place”.