In the United Kingdom, tomatoes are one of the most important product categories, as the supply includes a wide range of alternatives. Tomato derivatives – pulps, diced, chopped, pureed, paste, peeled, and juiced – are widely used as ingredients in the preparation of more or less elaborate condiments. Their destination is both Horeca and the retail market for domestic consumption. A recent survey (September 2022) conducted by Princes food group among more than 1,000 consumers (18-56) found that nearly a third (31%) of the British population will increase their purchases of canned vegetables in 2023.

The affordability of canned vegetables (63% of responses) is the main driver of growth amid high inflation (+9% in 2022 and at the same levels in this early part of 2023) and shelf life (46%), which minimizes food waste.

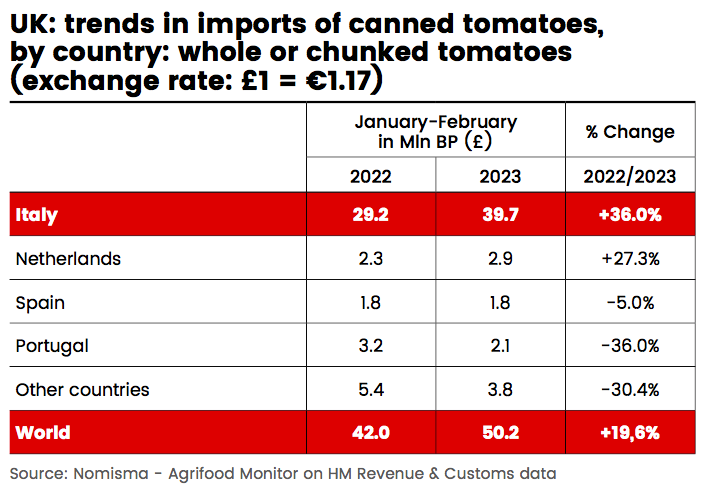

UK IMPORTS BY COUNTRY

Looking at each category, the share of consumers who specifically planned to increase their retail purchases of canned tomatoes was 35% of the total. Indeed, early data on trade balance trends seem to confirm that 2023 could be a favorable year for canned vegetables in general and especially for tomato derivatives. The origin of most of this product is mainly EU, Mediterranean in particular, and therefore largely Italian.

In the first two months of 2023 (January-February), the total value of British imports of tomato derivatives (whole, chopped and paste) from Italy increased by +37.1%, while the overall growth of this commodity from around the world stopped at +32.5%, demonstrating a dynamism of domestic supply that is higher than that of other competing countries.

The most lively supply segment was confirmed to be that of whole or chopped tomatoes, where the growth in imports from Italy was +36% (bringing the total value of imports to £39.9 million) in the face of an almost generalized retreat in product shipments by all other major European competitors. In this scenario, our country confirms its leadership as a supplier of this specific category of canned goods, peeled tomatoes in particular, with a share close to two-fifths (79%) of total imports.

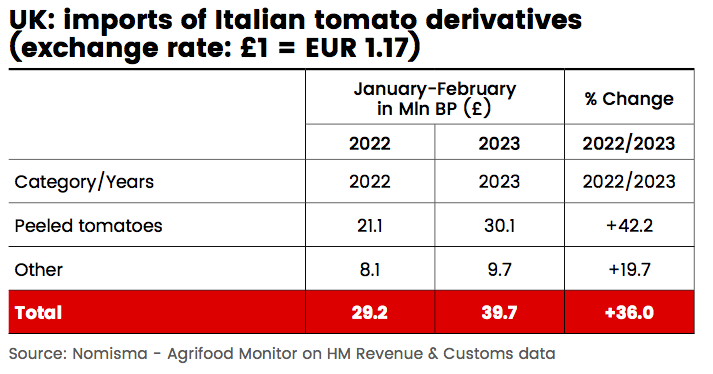

UK IMPORTS BY CATEGORY

Peeled tomatoes of Italian origin grew by +42.2%, rising to £30.1 million while other chopped tomatoes stopped at +19.7%, a more than satisfactory growth, however, given the current situation of great economic uncertainty that characterizes the British market. In the UK, the development of the canned vegetable sector is influenced by the competition exerted by fresh produce toward which consumer preferences tend to be directed. On the other hand, it should be noted how the lockdowns caused by Covid-19 reevaluated the culture of processed products as substitutes for fresh ones, emphasizing their advantages of ease and long shelf life.

VALUE FOR MONEY STILL IN TREND

In addition, the generalized rise in food prices is changing the consumption habits of Britons, but selectively, that is, orienting them toward products that, although more convenient in terms of price, are still perceived to be of quality by those who buy them.

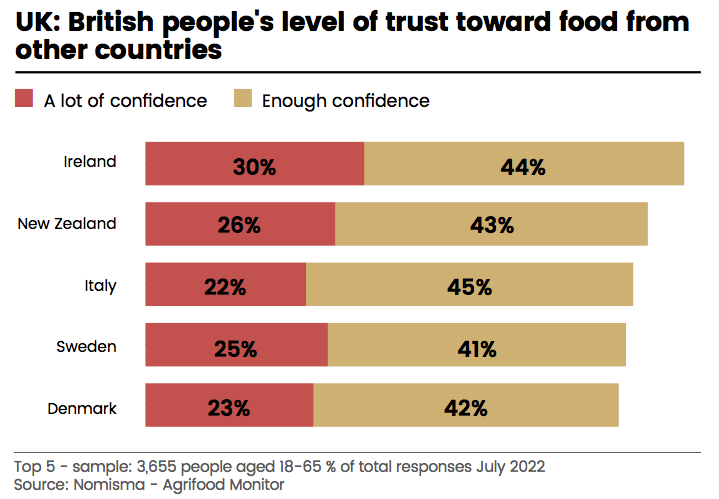

The latest survey conducted on the degree of trust the nation places in the food it buys and consumes (retail channel) revealed a generalized distrust of the quality of food from non-EU countries with which the UK has already signed or is in negotiations to close privileged tra- de agreements (India, Brazil) in the agri-food field. In particular, people put their trust in food from Europe. In fact, after Ireland (favored by geographic proximity) and New Zealand (prized especially for its lamb), it is Italy in which Britons place the most trust with regard to food quality (source: You Gov – The UK’s Trust in Food Index 2022).

Twenty-two percent of Britons have “a lot” of confidence in the quality of Italian food while 45% express their opinion with a “quite a lot” which brings their appreciation for our country to an overall 67 percent, i.e., a percentage that puts it ahead of Sweden (66%) and Denmark (63%). Noteworthy is the low regard given to U.S. foods, which are trusted by only 275 of British consumers. In this scenario there are the premises for the current large Italian companies marketing tomato derivatives on the British market (Conserve Italia, Mutti) to be joined in the future by other industrial brands at the expense of private labels whose weight in the sector currently stands at 45.5 percent.